taxing unrealized gains at death

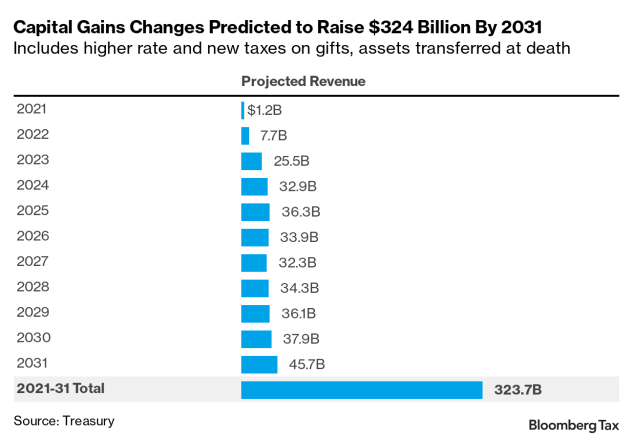

As part of the tax proposals in President Bidens American Families Plan AFP unrealized capital gains over 1 million would be taxed at death. The proposal is likely dead on arrival as it doesnt have the votes in Congress but in its present form it would levy a 20 minimum tax on all income including not just realized.

Democrats Are After Your Money With Wealth Taxes Even A Tax On Unrealized Gains Mish Talk Global Economic Trend Analysis

As part of the tax proposals in President Bidens American Families Plan AFP unrealized capital gains over 1 million would be taxed at death.

. In other words the unrealized gain magically disappears at ones death and is not subject to any income tax. When the House Ways and Means Committee produced its components of the Build Back Better Act it omitted a proposal to tax unrealized capital gains at the time of a. Is expected to lose almost 42 billion in tax revenue this year from the exclusion of capital gains from tax at death according to the Joint Committee on Taxation.

Introduced as legislation would tax capital gains at death with an exemption for the first 1 million of gain. For context repealing the existing estate tax would reduce revenues by about 300 billion over 10 years. The use of capital losses and carry-forwards from transfers at death would be allowed against capital gains income and up to 3000 of ordinary income on the decedents.

More than fifty years ago two leading tax experts described the failure to tax gains of property transferred at death as the most serious defect in our federal tax system To fix. Several bills in the 116th CongressHR. However this policy would.

If you decide to sell youd now have 14 in realized capital gains. Taxpayers may also hold onto assets with unrealized capital gains and pass the underlying assets and associated gains to an inheritor at death. An Obama Administration plan to tax capital gains at death would have.

At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains. Getting to that figure though requires redefining income altogetherand changing how they approach capital gains too. The use of capital losses and carry-forwards from transfers at death would be allowed against capital gains income and up to 3000 of ordinary income on the decedents.

However this policy would. Taxing unrealized gains as they accruewhich. More than fifty years ago two leading tax experts described the failure to tax gains of property transferred at death as the most serious defect in our federal tax system.

To fix this longstanding flaw our plan would tax unrealized gains at death for the very rich couples with more than 100 million and singles with more than 50 million at the. This is one of the biggest tax breaks in the tax code costing the government over. The only way to avoid paying taxes on the unrealized gains is to hold on to the investment indefinitely unless you die in which case the basis for the assets in your estate is.

In that situation the assets tax.

The Hidden Surprise In The Biden Green Book Tax Proposal Stableford

Hiltzik Why Elon Musk S Taxes Are Important Los Angeles Times

Biden S Plan Will Stop Billionaires From Avoiding Taxes Fortune

New Tax Initiatives Could Be Unveiled Commerce Trust Company

Step Up In Basis At Death Might Go Away Ross Law Firm Ltd

Don T Try To Mark To Market Capital Gains Tax Unrealized Gains At Death Instead Tax Policy Center

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Capital Gains Are Sensitive To Taxation Jct Report Tax Foundation

The Rich Benefit As Democrats Forgo Tax On Unrealized Capital Gains

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Capital Gains Tax Rates For 2022 Vs 2023 Kiplinger

Avoiding Basis Step Down At Death By Gifting Capital Losses

Ad Exaggerates Potential Impact Of Biden Estate Tax Plan The Washington Post

Biden S Tax Plan Is A Middle Class Death Tax Dressed As A Capital Aier

Billionaire Tax How Democrats Want To Pay For Their Social Spending Bill Cnn Politics

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

Trump S Tax Plan A New Death Tax For The Middle Class The Hill

Tax Pros Perplexed By Scope Of Biden S Capital Gains Overhaul